The working capital turnover ratio is a financial metric used by businesses to assess their operational efficiency and management of working capital. It provides insights into how effectively a company utilizes its working capital to generate sales revenue. Here’s an explanation of the working capital turnover ratio, its benefits, and how to calculate it.

Definition of Working Capital Turnover Ratio

The working capital turnover ratio, also known as the net working capital turnover ratio, measures the efficiency of a company in using its working capital to support its sales or revenue-generating activities. It helps assess how well a business can convert its current assets (e.g., inventory, accounts receivable) into sales.

Benefits of the Working Capital Turnover Ratio

Understanding and analyzing the working capital turnover ratio offers several benefits to businesses:

1. Operational Efficiency: It indicates how efficiently a company manages its working capital to support its operations. A higher ratio typically signifies better efficiency.

2. Liquidity Assessment: The ratio helps in assessing a company’s liquidity position. A high ratio may indicate that the company is not using its current assets efficiently, while a low ratio may suggest liquidity problems.

3. Comparison: It allows for comparisons between different periods or with industry benchmarks. This helps identify trends and areas that may require attention.

4. Inventory Management: For companies with significant inventory, the ratio can highlight how well they are managing inventory turnover and reducing carrying costs.

Formula Calculation

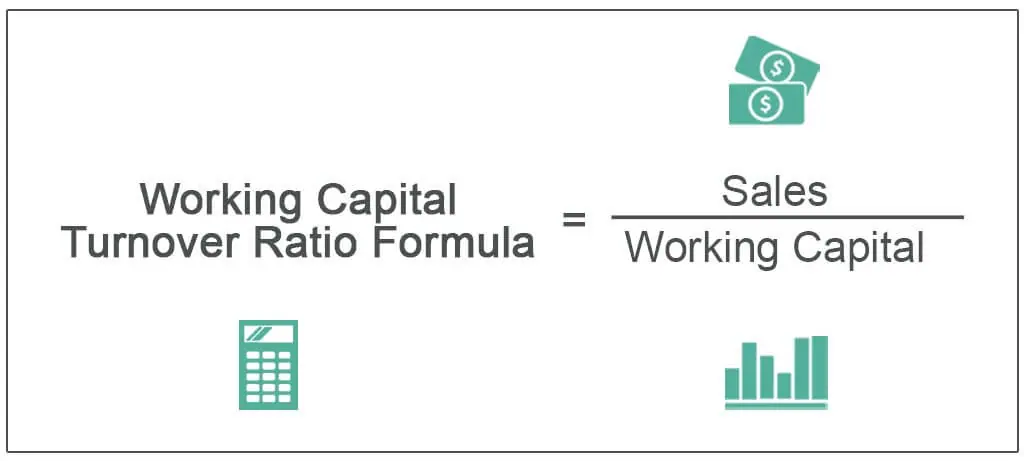

The working capital turnover ratio is calculated using the following formula:

Working Capital Turnover Ratio=(Net Sales/Average Working Capital)

Where:

• Net Sales: This represents the total sales revenue generated by the company during a specific period, excluding any sales returns, allowances, and discounts.

• Average Working Capital: This is the average amount of working capital available to the company during the same period. It is typically calculated as (Opening Working Capital+Closing Working Capital)/2.

Interpreting the Ratio

• A high working capital turnover ratio suggests that the company efficiently uses its working capital to generate sales. However, an extremely high ratio might indicate that the company is underutilizing its assets or facing liquidity issues.

• A low ratio may indicate that the company is not efficiently managing its working capital, potentially resulting in excess inventory or accounts receivable.

Example Calculation

Let’s say a company had net sales of $500,000 during the year and an average working capital of $100,000. Using the formula:

Working Capital Turnover Ratio – ($500,000/$100,000) = 5

In this example, the working capital turnover ratio is 5, indicating that for every $1 of working capital, the company generated $5 in sales revenue during the year.

In conclusion, the working capital turnover ratio is a valuable financial metric that provides insights into a company’s operational efficiency and liquidity management. By regularly calculating and analyzing this ratio, businesses can make informed decisions to optimize their working capital and improve their financial performance.